About Hutsy Financial

The Revolution of the Financial Industry

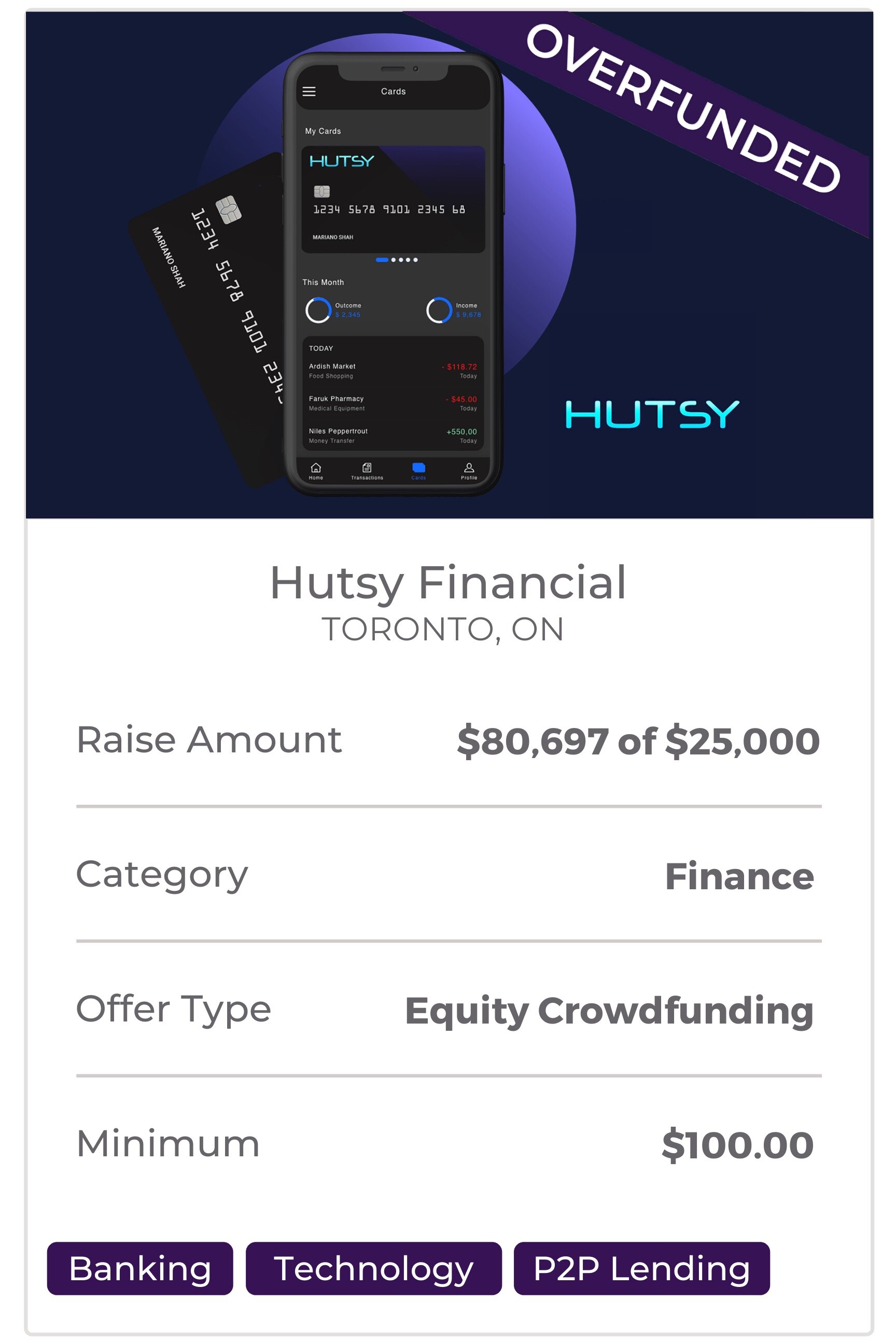

Hutsy Financial is a neo-bank (an online bank with no physical branches) that plans to offer prepaid, reloadable cards as well as an integrated application that gives clients real-time insights into their spending.

Hutsy intends to revolutionize the financial industry and make managing personal finances more convenient and accessible by providing in-app credit reporting, automated investment options, ending the payday lending industry, and leveraging an AI-first approach.

Payday lenders have preyed on many Canadians living paycheque to paycheque by charging APRs well over 400%, and up to 780% since the COVID-19 pandemic started. Hutsy plans to put an end to predatory lending by providing users early access to payroll as long as they have a direct deposit payroll going into Hutsy.

According to Benefits Canada, 56% of Canadians over 50 don’t have a retirement savings plan.

Hutsy plans to incentivize Canadians to save through a feature that rounds up spare change on all purchases, and automatically invests that change into the stock market.

With an integrated companion app, Hutsy will help users get cash back, save, and track their finances with ease.

The Campaign

CEO and Founder Tefari Bailey witnessed firsthand the harsh realities of trying to secure financial wellbeing while struggling with unsecured debt. During his time as a financial advisor at a major Canadian financial institution, he often wished he could do more for his clients as he watched so many get declined, and ultimately resort to payday lenders. He decided to team up with Tare Kabowei and Shaniqua De Gannes to create Hutsy Fianancial.

Hutsy Financial launched an equity crowdfunding campaign in late February 2021 to fund development of their prepaid visa card platform as well as acquire new customers through marketing efforts.

By closing, Hutsy’s origin story and execution plan had helped propel their campaign to break an Equivesto record, raising over 322% of their funding goal!

Campaign Statistics

$80,697

Capital Raised

115

# of Investors

14/05/21

Funded Date

$25,000

Funding Goal

322.78%

Overfunded

Equity Crowdfunding

Offer Type

Where are the Now?

Dragons Den: Season 16 Episode 8

Hutsy Financial was successfully able to raise $500,000 on CBC's Dragons Den from Angel Investing Titan, Wes Hall. Watch the pitch here.

An update message from Hutsy's CEO, Tefari Bailey:

After raising capital on Equivesto the Hutsy team was able to put the funds to good use to hire an external tech team to build a mockup for the UI/UX design of the Hutsy application. What we have created can be found here. Fast forward months later after our Equivesto crowdfunding round Hutsy was selected to appear on CBC’s Dragons Den where we have accepted $500,000.

This marks an important milestone in our company’s history and I’m really glad to be sharing the moment with the Equivesto community which made all of this possible. As a lot of you have been investors, shareholders, supporters and mentors to me and the team. Since our Equivesto crowdfunding round we worked hard to get here and it certainly has been a journey filled with many highs and lows. With Wes Hall from Dragons Den investing in Hutsy there is a lot to be proud of as this is a major vote of confidence in what we’ve done and our potential to build something special.

I am certainly not trying to burst the celebratory bubble. Raising capital is absolutely a good news story. But it’s important that we don’t interpret this fundraise round as a declaration of success. We must remain humble. We must remain hungry. And we must continue to make the most out of every dollar that we have. Too many companies have fallen flat on their face after a fundraise thinking that they now have money to spend on fancy furniture, higher salaries, lavish parties, and other fluff. We must not get carried away and fall into those temptations. We must remain focused on the things that truly matter.

Our plans moving forward are very simple: get things done! Build out our technology stack, frameworks, and business practices to prepare ourselves for our beta launch, the target date for this is May of 2022. As well as to speak with our waitlist users as well as our investors to get feedback on our prototype application, to ensure when we are ready to launch we deliver an exceptional product and can really change the way banking is done for the underserved.