INVESTOR STREAM

Signing up on Equivesto

This page explains the details of how to sign up on Equivesto and apply for an account. If you started an application and need to get back to your forms click here, or email support@equivesto.com.

To start signing up on Equivesto, visit https://portal.equivesto.com/signup

Make sure to select ‘Investing’ if you are signing up to invest in companies.

Select ‘Raising Capital’ if you are a company looking to raise money from investors.

You can connect your LinkedIn or Facebook information, but that is not necessary.

After clicking Sign Up, Equivesto will send you an automated email to verify your email address.

In that email will be a link to verify you. Once you click that link, Equivesto will direct you back to the Equivesto portal, where you can now complete your Investor Application Forms

The first page of the Equivesto Investor Application Form welcomes you to Equivesto, talks about what becoming an investor means, and let’s you know how long the signup process will take (only a few minutes).

Next, you select how you are signing up as an investor.

If you are investing on your personal behalf, select ‘This is Me’ next to ‘An Individual’.

If you have a holding company that you would like to invest through, or are signing up as a Venture Capital firm, please select ‘Corporate of Other Legal Entity’.

The next page is the beginning of the form. Here you will provide your full legal name, your address, and your date of birth.

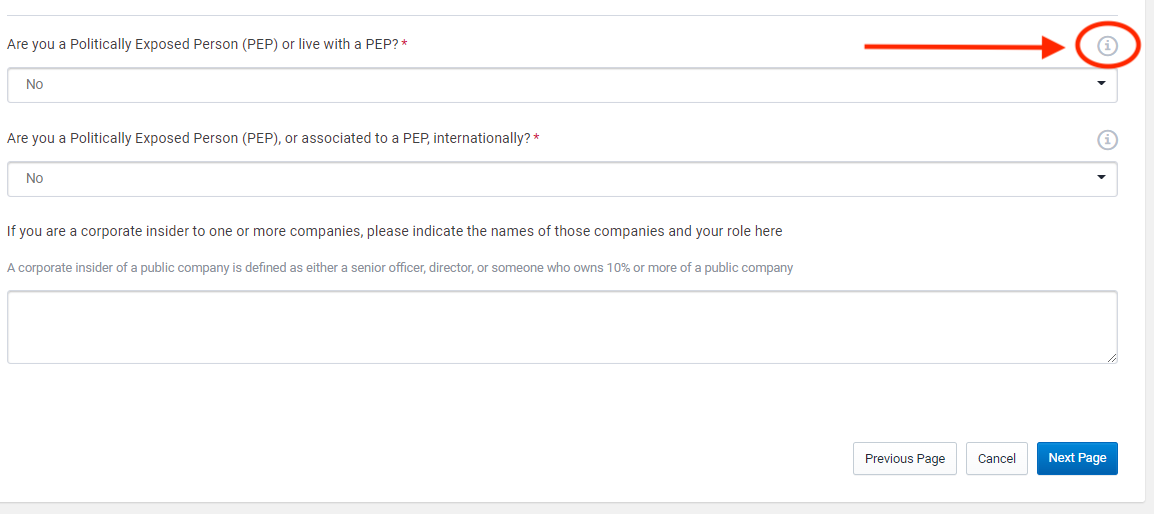

Lower on the page, we ask you to confirm if you are a politically exposed person, or a corporate insider. For a definition of Politically exposed person, please move your mouse over the ‘i’ button to the right.

On the next page, we ask about your marital status. If you are married or Common Law, we are required to collect information on your legal spouse. Why do we collect this information? Visit https://equivesto.com/investor-path/investor-information to learn more.

Next, we ask about providing a Trusted Contact Person. Why do we collect this information? Visit https://equivesto.com/investor-path/investor-information to learn more.

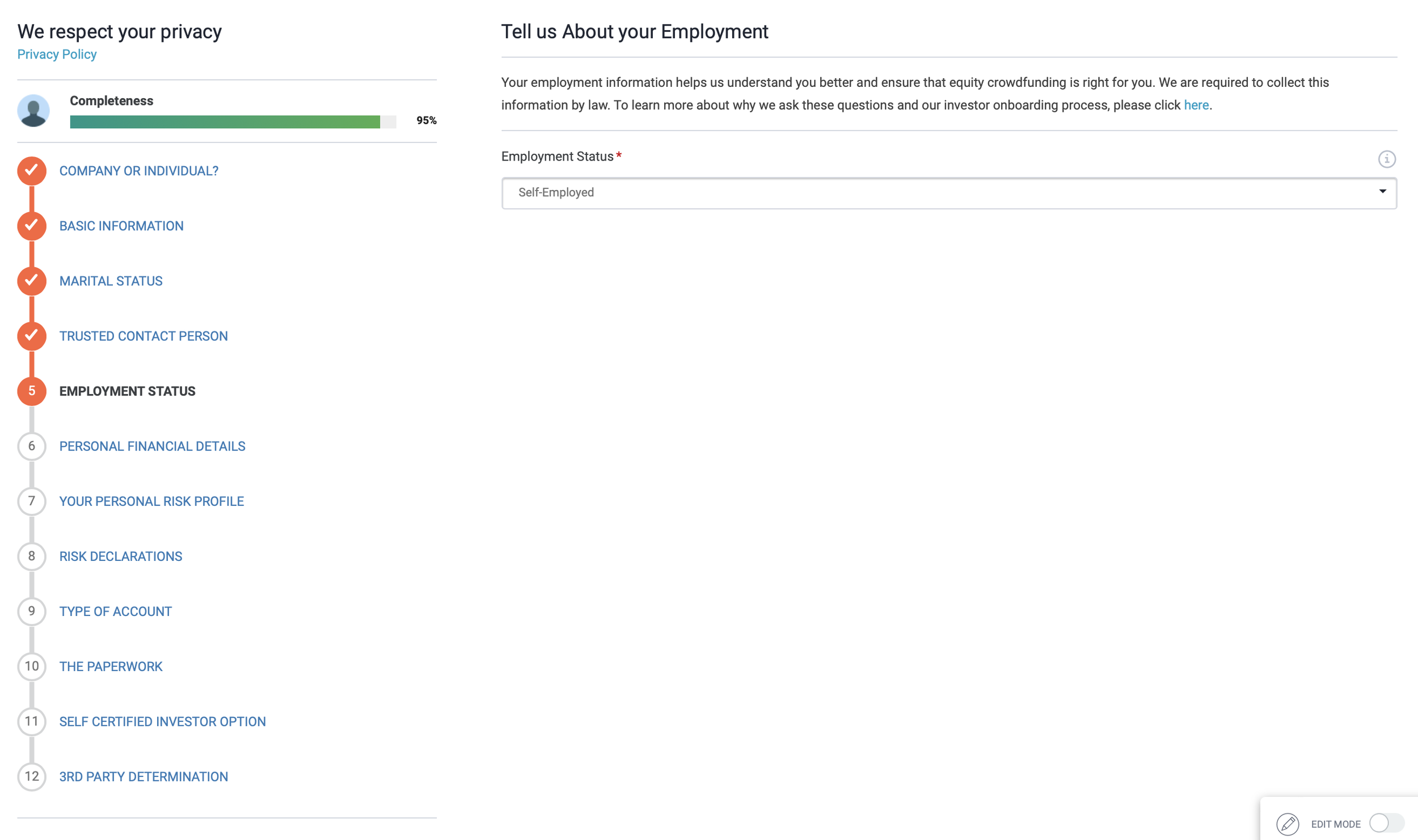

On the following page, we ask about your employment status. Why do we collect this information? Visit https://equivesto.com/investor-path/investor-information to learn more.

Step 6 asks about your personal financial details. We are required to collect this information so we can get a full picture of your financial situation and can understand whether investments on Equivesto are suitable for you, and what investment limits might make sense. Visit https://equivesto.com/investor-path/investor-information to learn more

What should you put in the ‘Total Income’ section?

This is the average total income you (or you and your spouse) have earned over the past 2 years, and expect to earn in the future. Please put the amount before taxes here.

What should you put for ‘Net Worth’?

Net worth is the total value of everything you own, minus any debts or amounts you owe on it. For help calculating your next worth, please use our net worth calculator here (https://equivesto.com/networth )

What should you put for ‘Net Financial Assets’?

Net financial assets is the total value of all financial assets you own, including cash, minus any debts you have. Net Financial Assets include cash, checking accounts, savings accounts, investment accounts, pensions, funds, RRSPs, TFSAs, etc. Net financial assets does not include any real estate, including your personal residence, or any mortgage you might have.

Step 7 covers your personal risk profile, and asks questions about your previous experience investing, and the risk you are willing to take with investments on Equivesto.

For a definition of the level used for investment knowledge, please highlight the ‘i’ symbol to the right.

For Risk tolerance, please make sure to provide your risk tolerance for the investments you make on Equivesto ONLY. For a definition of the level used for risk tolerance, please highlight the ‘i’ symbol to the right.

Please note, all investments on Equivesto are considered High Risk, and as such, require an ‘Aggressive’ risk tolerance.

Step 8 covers key risk declarations associated with being an investor client and investor via the Equivesto platform. Please read each closely and make sure you understand. Use the ‘i’ symbol if you would like clarification on a statement.

Step 9 is the Account Type selection screen. Based on information you have input previously on the form, the Equivesto system will determine which account types you may be suitable for.

Please click here for a breakdown of all account types on Equivesto https://equivesto.com/investor-path/types-of-investors

All account types other than Retail Investor/Client have higher investment limits but require additional personal financial documents.

Please read the details below each account type to determine what is required to be proven for that account type.

Step 10 is an optional step. If you chose to proceed as a Retail Client, step 10 will be skipped.

If you chose to proceed as either an Eligible Investor, Accredited Investor, or Permitted Client, Step 10 will ask that you provide documentation to support that investor status.

This page will only allow one document to be attached. If you need to provide more documents than one, a member of the Equivesto team will reach out after you submit your application to securely collect them.

Please ensure the documents you provide, income documents (like a T4 or Notice of Assessment) or asset documents (like bank account statements or investment statements) correctly respond to the correct information you are using as proof of investor status.

For example, if you qualify as an eligible investor because you have over $400,000 in net financial assets, please do not provide your Notice of Assessment from last year.

Step 11 is an optional step for Retail or Eligible Investors. Investors who can demonstrate they have adequate financial and investment knowledge or certification can be approved as a ‘Self-Certified Investor’.

Self-Certified Investors have increased limits up to $30,000 per year and participate in ‘Accredited Investor’ only deals. Currently limited to residents of Ontario, Alberta, & Saskatchewan only. Learn more here.

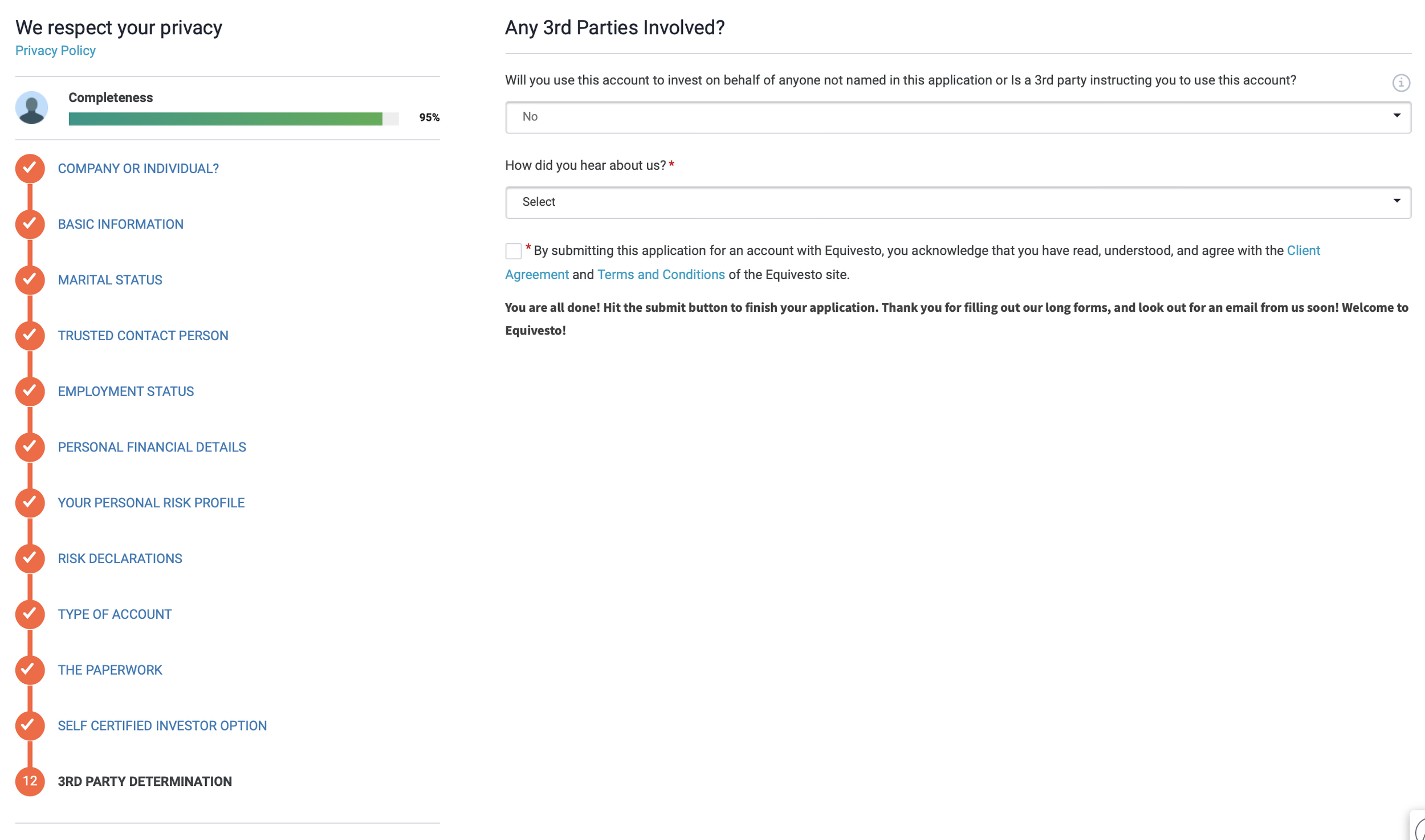

The final step is to confirm who is using this account. If you are signing up to invest on behalf of someone under 18, this is where you would provide that person’s information, without your information being used everywhere previously on the form.

If there is no one else benefitting from this account other than you and your spouse, please select No.

Once the application form is submitted, it will be reviewed by a member of the Equivesto team. If the team requires any additional documents, like a copy of your photo ID or more financial documents, the Equivesto team member will email you. An Equivesto team member will also email you if we have any questions about your application.

If there are no questions, you will receive your account approval and assigned investment limits within1 business day. Please reach out to support@equivesto.com if you have questions at any time.

Wait, I was filling out my forms and had to stop. How do I get back? Visit this page